Outrageous Info About How To Appeal Against Council Tax Banding

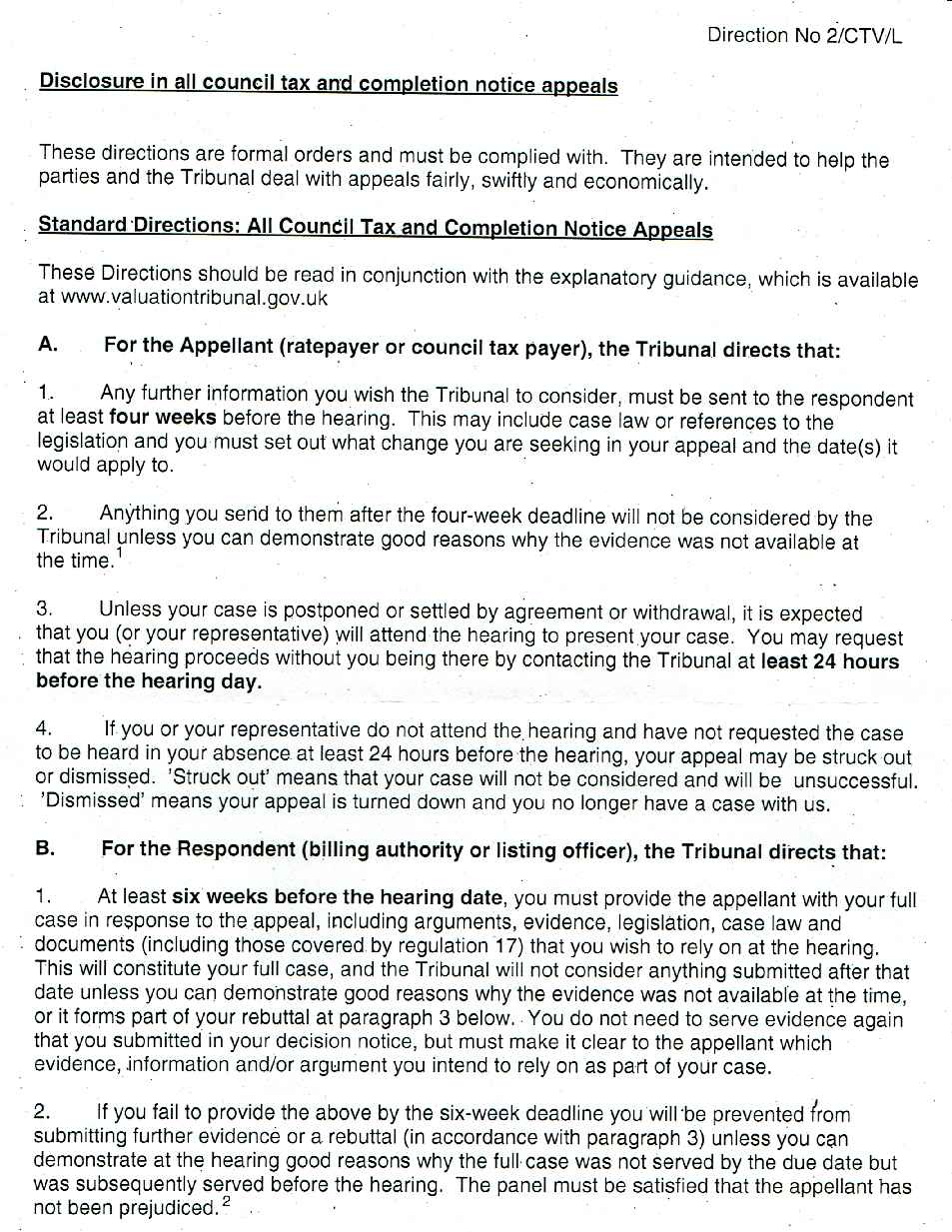

If you are reporting a problem to us, or appealing a council tax band, you must continue to pay council tax as per your bill.

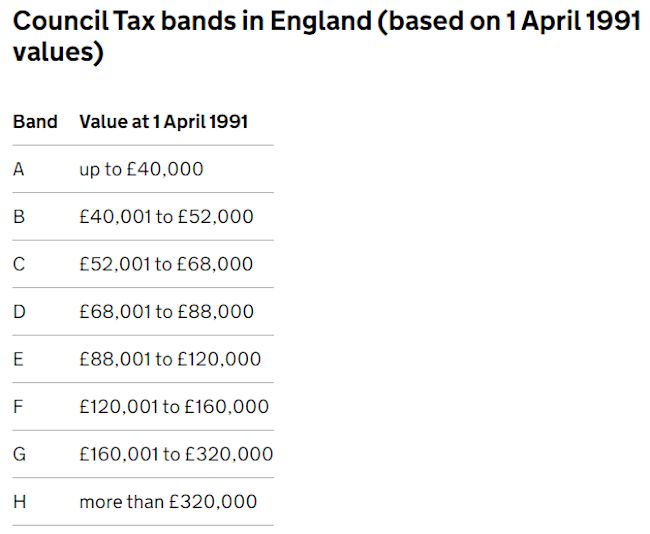

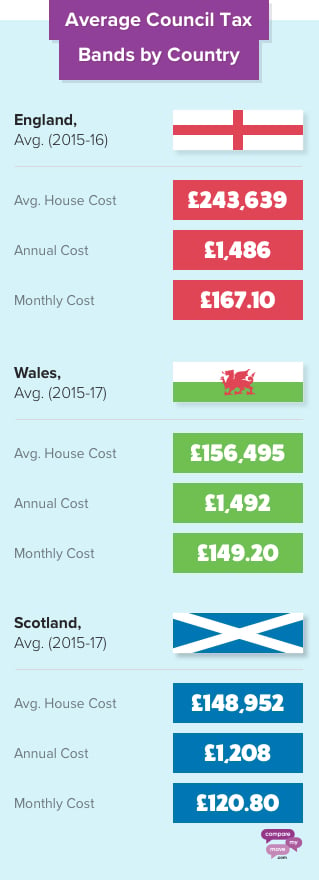

How to appeal against council tax banding. If you want to appeal about a completion notice because you. The valuation office agency (voa) sets your council tax band. The grounds for appeal against your council tax banding include:

We do not set council tax bands for properties. Appeals against the banding of your property. You cannot appeal against the general levels of council tax set by the council each year.

Government » city government » city council. How to appeal against your council tax band. The valuation office agency (voa) is responsible for setting council tax bands.

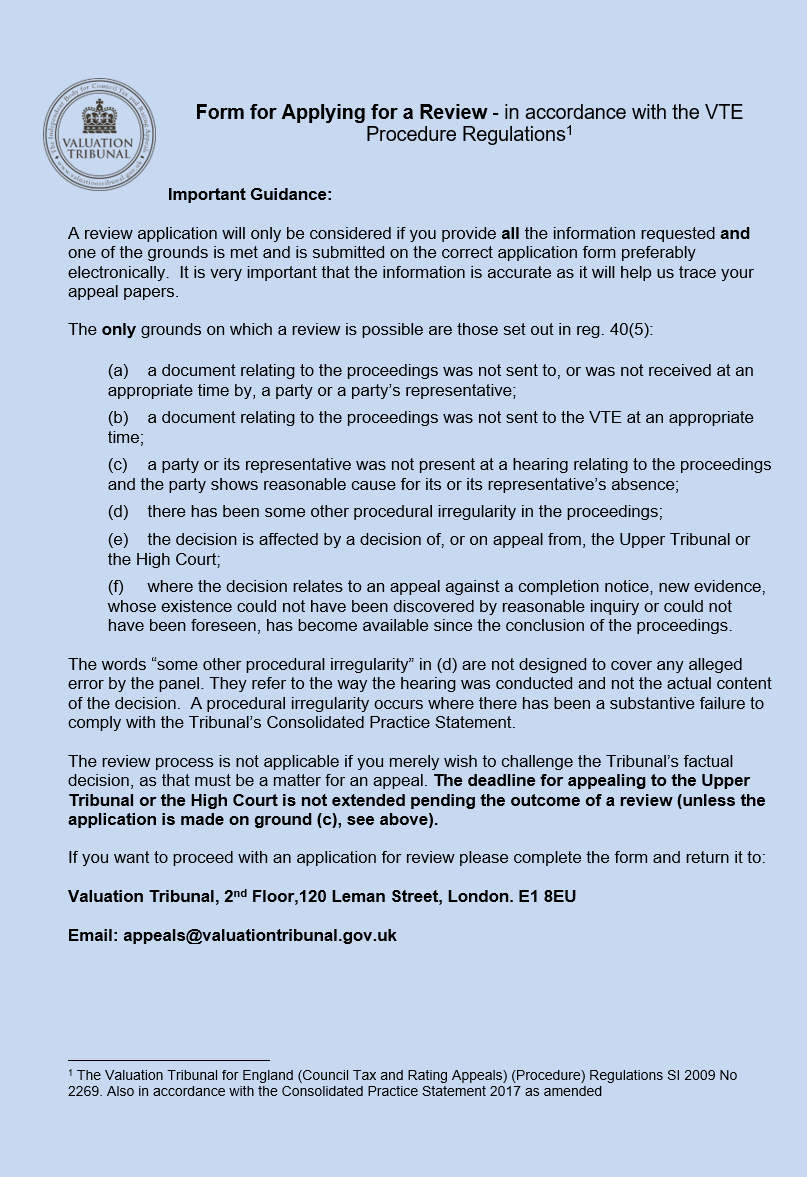

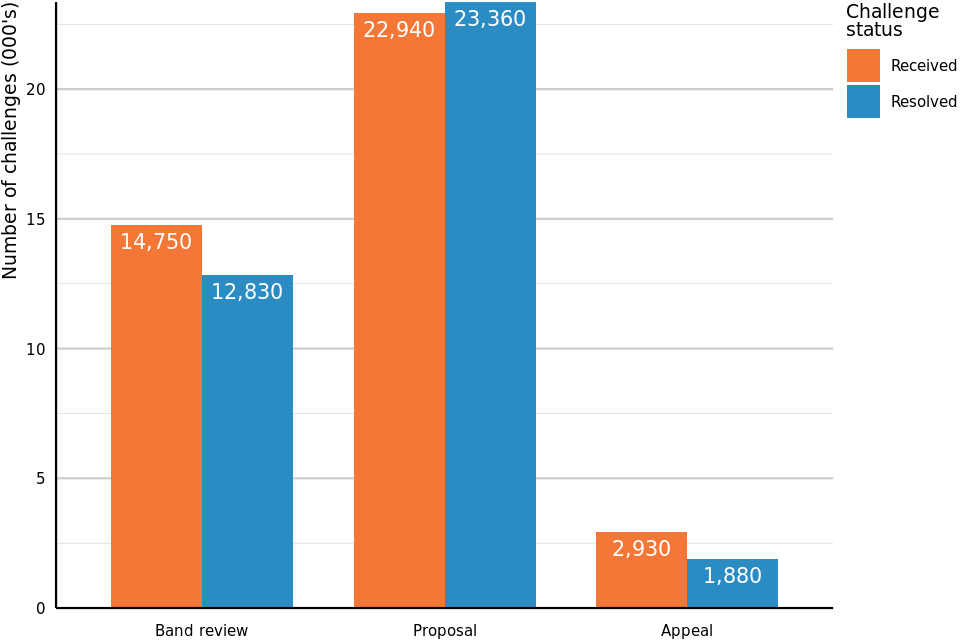

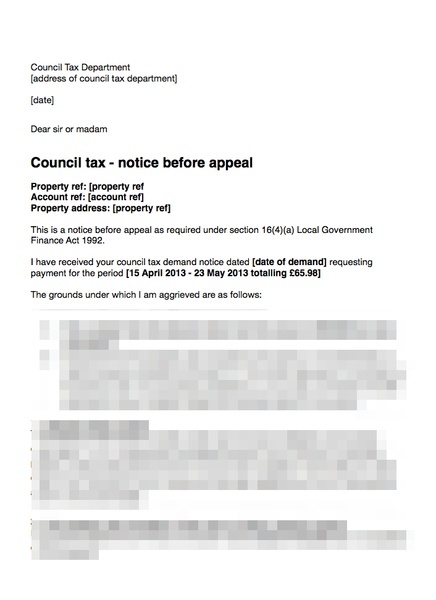

Grounds for making an appeal are: You have a further right of appeal to a valuation tribunal if you still disagree with the council's decision. You can view your property and check if you can request a review, by selecting 'council tax' on the valuation office agency (opens in a new.

You believe the property should not be in the. Initial appeals should be addressed to the council tax section, civic centre,. You must include supporting evidence for each parcel you wish to protest such as closing statements, recent fee appraisals, photos, comparable sales, etc.

Share & bookmark share & bookmark, press enter to show all options, press tab go to next option. Council tax bands are allocated by the valuation office agency (voa) and not the council. (c) any taxpayer entitled to appeal to the tax tribunal pursuant to subsection (a) above shall commence an appeal by filing a notice of appeal with the tax tribunal.