Fine Beautiful Tips About How To Become A Non Taxpayer

Earn your high school diploma or ged.

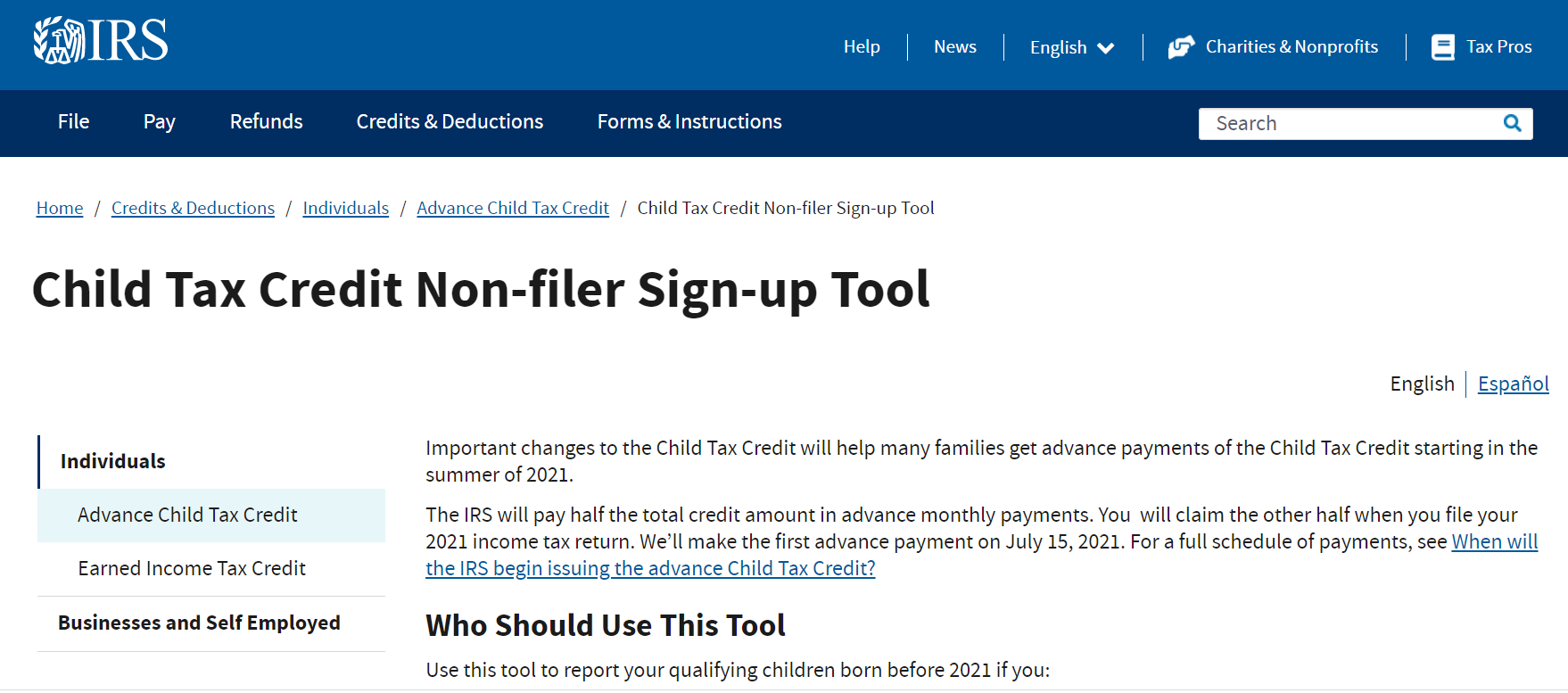

How to become a non taxpayer. The questions that follow will help you determine if an organization is eligible to apply for recognition of exemption from federal income taxation. As of january 31, 2020,. However, in some cases, you may be required to file tax returns in two.

You are physically present in south africa for 183 days or more in a tax year unless you convince the ato that your usual place of residence. The statutory residence test (srt) framework outlines the rules and records required to become non uk tax resident. Any tax professional with an irs preparer tax identification number (ptin) is authorized to prepare federal tax returns.

Their first year of rmds at age 72 falls from $435,820 to $215,281. How do i become a non tax resident in south africa? You can register to receive savings interest without deduction of tax at source by the bank/building society by contacting each of them and following their instructions other.

The “person” they are referring to above is further characterized as a “citizen of the united states” or. Register for a sales and use tax or meals and rooms tax license. The term ''taxpayer'' means any person subject to any internal revenue tax.

You don't need to be a genius. You can cease tax residency on the grounds of the physical presence test, ordinary residence test or by applying the double tax agreement legislation, if applicable. The advice tends to be, in general, i must stay out of australia for 2 years and have a long term residency somewhere.

However, tax professionals have differing levels of skills, education. While it’s not required that you. In general, if you’re working remotely you’ll only have to file and pay income taxes in the state where you live.

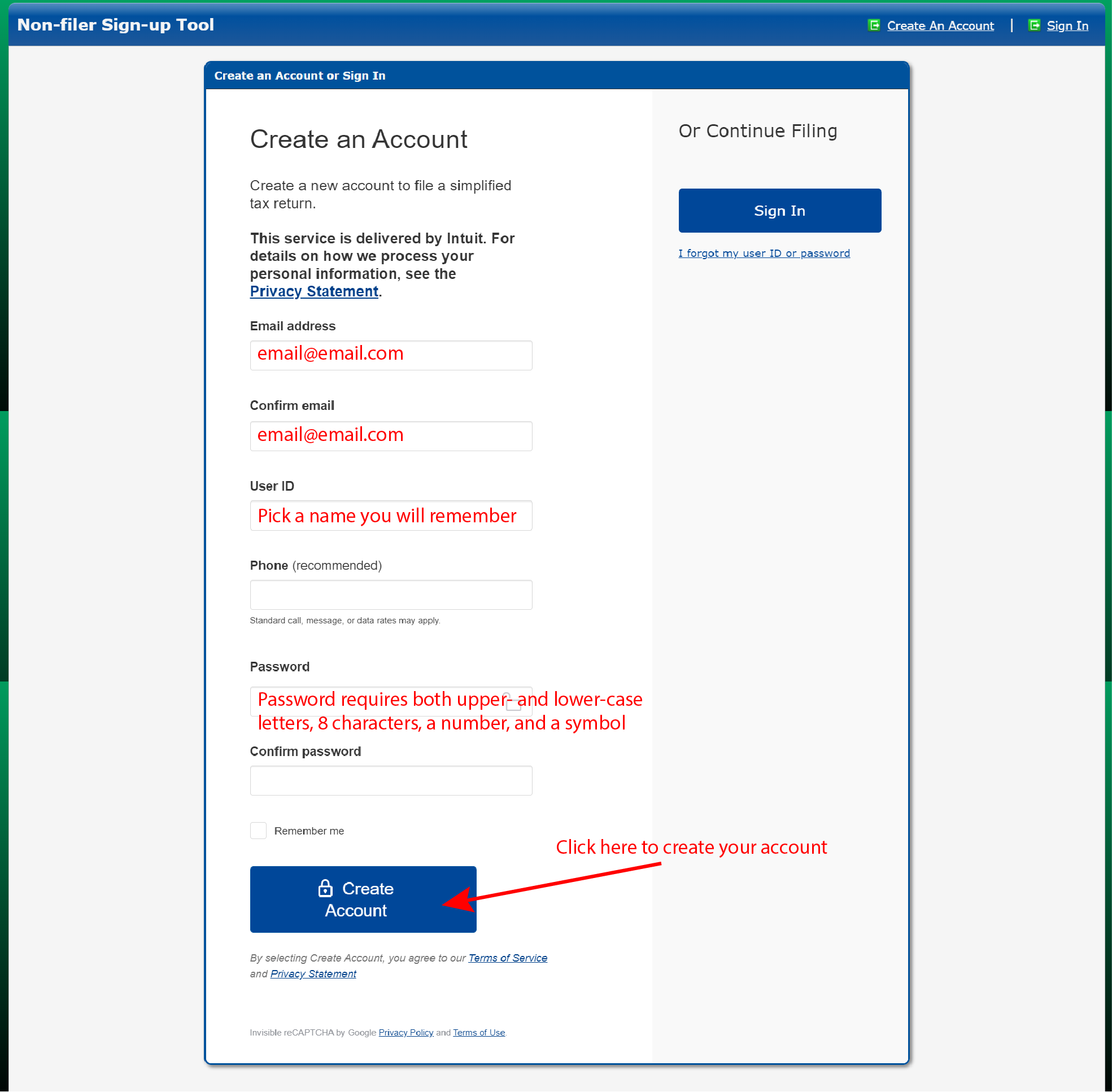

/ScreenShot2021-05-17at12.18.32PM-420d9ea4a4974f85814c456d6f5fe2f3.png)

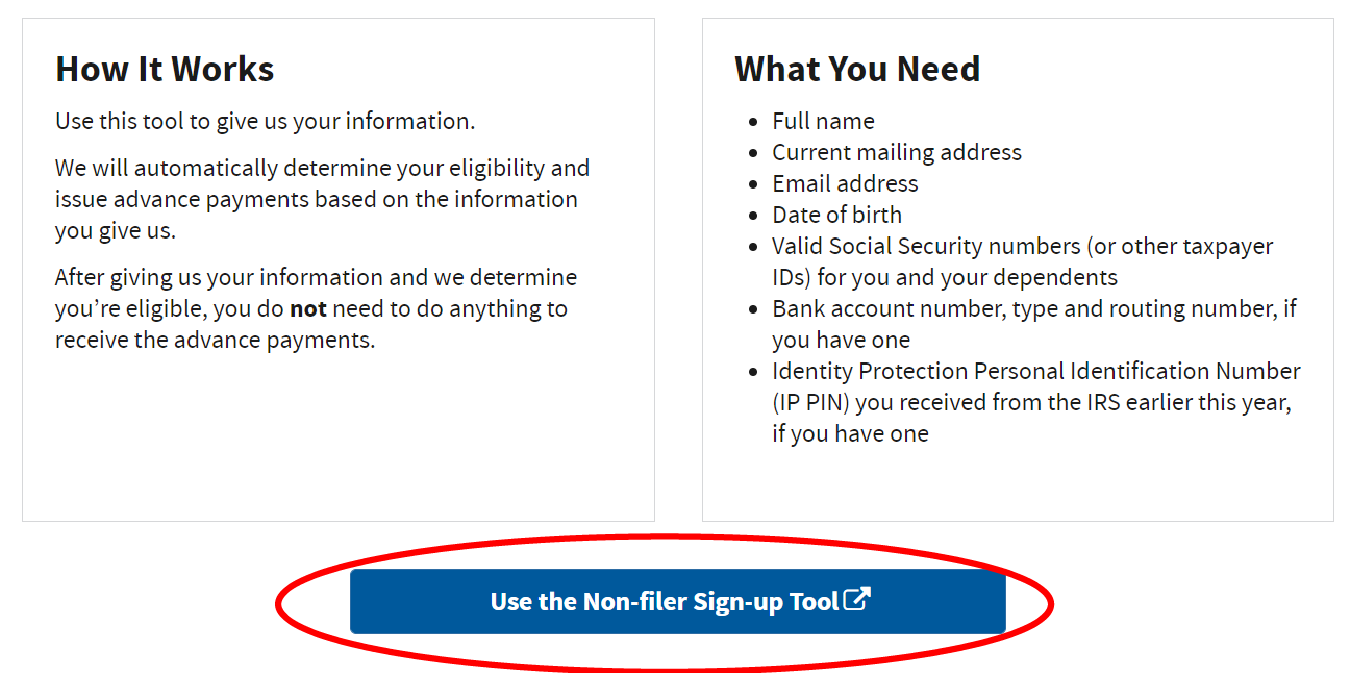

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)

![Ultimate Us Llc Guide For [Non-Residents] In 2021](https://globalisationguide.org/wp-content/uploads/2019/06/US-LLC-NON-RESIDENT-FOREIGNER.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.18.32PM-420d9ea4a4974f85814c456d6f5fe2f3.png)