Top Notch Info About How To Become A Tax Accountant

![How To Become A Tax Consultant [Education Requirements & More]](https://www.wgu.edu/content/dam/web-sites/blog-newsroom/blog/images/national/2020/september/studying-tools-youve-never-heard-of.jpg)

Tax accountants who take courses in tax law are.

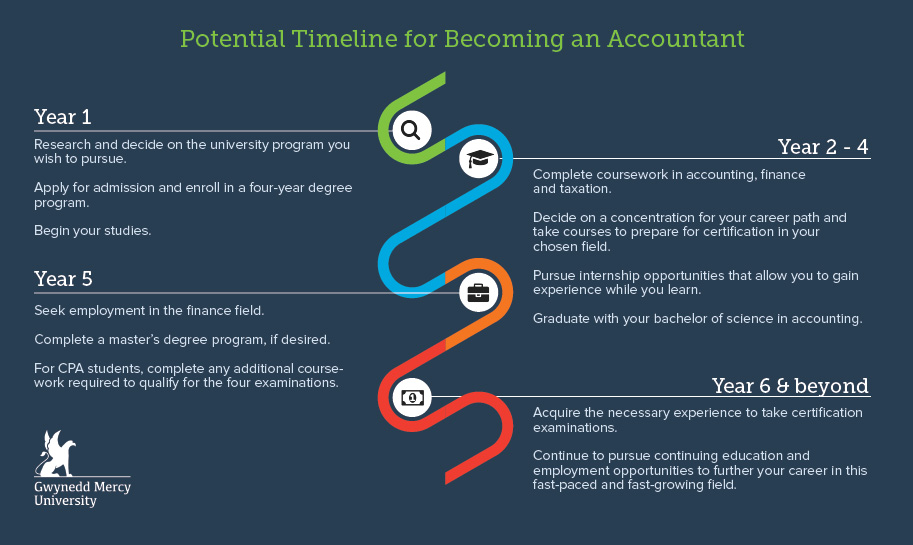

How to become a tax accountant. How to become a tax accountant in 7 steps: Cpa candidates must hold a bachelor’s degree and additional educational qualifications. You can become a tax accountant by completing an undergraduate and master’s degree in accounting fields, developing skills in compliance, tax reporting, and financial management,.

How to become a tax accountant. How to become a tax accountant. If you graduate with a diploma of accounting, you need to have two years of work experience within the last five.

To become a tax accountant, individuals need to develop professional skills, study for relevant qualifications and gain invaluable work. From a sheer education perspective, a bachelor’s degree is traditionally sufficient for how to become a tax accountant. But many decide to take things a bit further by reinforcing their.

Each state sets its own educational criteria for the cpa. Do your own taxes starting with the first year you earn income to help learn the process from the ground up. Complete one year of public accounting or two years in a qualifying accounting position in the accounting industry, business, government or teaching.

Salary ranges can vary widely depending on. Additionally, tax accountant typically reports to. Begin the process of becoming a tax accountant by.

The average income tax accountant salary in montgomery, al is $66,977 as of , but the salary range typically falls between $59,638 and $75,263. Make sure you have right skills for tax accountant. Approximately 35% of accounting graduates are hired to work in taxation, so the earlier you.

![How To Become A Tax Consultant [Education Requirements & More]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1174262745.jpg)

![Tax Consultant & Specialist Job Description [Career Overview]](https://www.accounting.com/app/uploads/2020/10/GettyImages-1168618923.jpg)